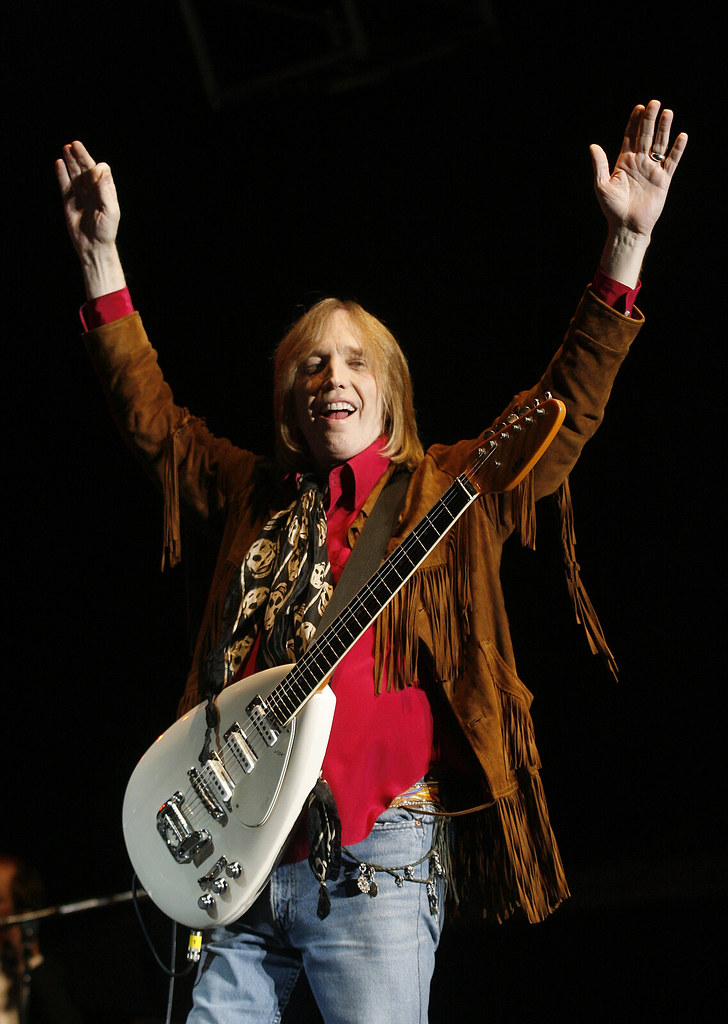

Tom Petty is in good company, not just as a rock-n-roll legend, but as another star whose estate is in turmoil. The plethora of lawsuits are Free Fallin’ as Petty’s wife, Dana, and the two daughters from a previous marriage, Adria and Annakim, fight over control of the $95 million he left behind.

Unlike Aretha Franklin, Prince, and Michael Jackson—who had done absolutely no estate planning—Petty did at least have a trust. But the trust contains some fuzzy language which is at the heart of the dispute.

Dana Petty’s lawsuit calls the actions of Adria and Annakim “abusive” and “erratic.” The girls’ lawsuit accuses Dana of “gross mismanagement” costing them more than $5 million.

Petty’s trust specifically named his wife, Dana, as sole trustee, giving her control over managing the trust assets. The trust required her to transfer the artistic properties into a new limited liability company (LLC) where Dana, Adria, and Annakim “shall be entitled to participate equally in the management of the Artistic Property Entity.”

The phrase “participate equally” is what the courts will have to decide. According to Dana Petty’s lawsuit, the daughters believe “participate equally” means all three get to vote and the majority rules, which means the daughters could overrule Dana’s wishes whenever they want. Dana Petty believes “participate equally” means all three will share equally in the benefits of the LLC.

You may not have a $95 million estate, but there are lessons to be learned from the Tom Petty saga. In any estate planning, especially when a blended family is involved, be clear; be specific; leave nothing to chance. Language matters and if you want to assure that your wishes are carried out after you’re gone, make sure there’s absolutely no question about who the executor or trustee is, what they’re duties are, and who the beneficiaries of your estate are. Then, the settlement of your estate should be wildflowers rather than wildfires.