Retirement is a magical word. It means different things to different people. Whether it’s traveling the world and never having to work again, beginning a new career or business, or volunteering, you need enough income to pursue your definition of retirement.

How much money do you need? The number is different for every person. But there are certain markers everyone contemplating retirement needs to consider.

How much money have you saved?

Since it was signed into law on August 14, 1935, Social Security was always intended to supplement other retirement income, not be the sole source of retirement income. Today, people save in tax-deferred retirement accounts such as IRAs, 401(k)s, 403(b)s, and a host of other employer-sponsored plans as well as non-retirement accounts. No one wants to just get by in retirement. So, how big does your pool of money need to be?

A good start is to a savings pool 10 times the amount you’re making when you retire. That’s a basic rule of thumb. But don’t stop there. Find out exactly how much income your investments will reasonably produce and if that income will fluctuate in a bad market. Compare that income to the amount you need to fund your retirement lifestyle.

How much will you withdraw

Taking too much money from your investments can make the retirement well run dry and leave you to survive on Social Security. How much do you withdraw? Some say pick a reasonable percentage and go with it. That sounds great. If your portfolio averages a 6% return you should be able to withdraw 6% every year and not have to worry. The problem is, markets don’t generate the same consistent return year after year.

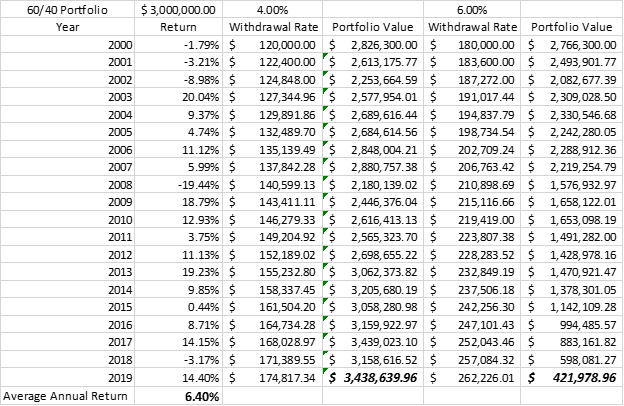

You have to consider the Sequence of Returns risk. If you retire and the market has a series of negative returns, even small ones, taking 6%, as mentioned above, can start your portfolio on a downward trajectory that will impact you for the rest of your retirement. Look at this actual example of a $3,000,000 portfolio from 2000 through 2019, withdrawing 4% and 6% during the same time period.

In this case, the 4% withdrawal rate is obviously sustainable and the account value continues to grow. With the 6% withdrawal rate, even though it is less than the average annual return, the balance declines and would soon hit zero. In fact, if you change the withdrawal rate to 6.3%, the balance falls below zero in 2019.

What is your Social Security claiming strategy?

Social Security shouldn’t be your entire retirement income source, but it will play a large part in your overall success. Things to consider:

- When will you begin Social Security?

- You can take Social Security as early as 62.

- Taking Social Security between 62 and your Full Retirement Age will give you a permanently reduced Social Security benefit.

- If you wait until age 70 to begin, you will receive delayed credits between your Full Retirement Age and age 70. Those delayed credits increase the amount you receive by 8% each year until 70 giving you a larger payout than you would have received at Full Retirement Age.

- Can you wait until age 70 to start taking Social Security?

- Can you receive Social Security based on someone else’s work history and then switch to your own benefit later?

- Are you eligible for a Spousal or Survivor benefit? If so, when is the best time to begin that benefit?

There’s a strategy when it comes to claiming Social Security. You need to know what your strategy is to maximize your benefit.

Do you have a retirement budget?

It’s just as important to have a budget in retirement as it is while you’re still working. How much will it take for you to live in retirement and where is the money going to come from. There’s an old rule of thumb that says you’ll need 85% of what you were making when you were working. I believe your budget should be 100% of what you were making.

Yes, there are some expenses that will go down or go away altogether, but the cost of healthcare continues to go up. Inflation will continue to drive up prices of goods and services. And you may want to do some traveling or get involved in new hobbies–things that weren’t included in the budget you had during your working years. Creating a retirement budget will help you see where you stand.

Do you know how you’ll be taxed?

Taxes don’t go away just because you retire and you need to consider taxes where you intend to spend your retirement years.

There are nine states that have no state income taxes: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. With no state income tax, you don’t have to worry about paying taxes on distributions from 401(k) plans, IRAs, or pensions.

Illinois, Mississippi, and Pennsylvania have state income taxes, but they do not tax distributions from 401(k) plans, IRAs, or pensions.

Alabama and Hawaii don’t tax pensions, but they do tax 401(k) and IRA distributions.

Other states allow various tax breaks on retirement income. Alabama, Arkansas, Connecticut, Hawaii, Idaho, Illinois, Kansas, Louisiana, Maine, Massachusetts, Missouri, New Jersey, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, West Virginia, and Wisconsin don’t tax military retirement income.

Virginia taxes all military retirement income except that of Congressional Medal of Honor recipients.

Colorado allows taxpayers 65 and older to subtract $24,000 from their federal adjusted gross income (AGI), which is the number used to calculate state tax.

Connecticut teachers get to subtract 25 percent of their retirement income from federal adjusted gross income.

Keep in mind, states will get their money somewhere. States with low or no income taxes may have higher property or sales taxes. Case in point—Illinois doesn’t tax retirement income, but it has one of the highest sales and property taxes in the country. Tennessee has no state income tax but has a sales tax of 9.75%

Knowing if you’re financially ready to retire will take time and effort, but can save you in the long run.