After 40 years, a new chapter is being written in the saga of high inflation. Some of us are old enough to remember the ugly story the last time in happened. But for millions of Americans, this is their first rodeo. As the price of everything has gone through the roof, Americans are increasingly turning to credit cards to pay for everyday essentials.

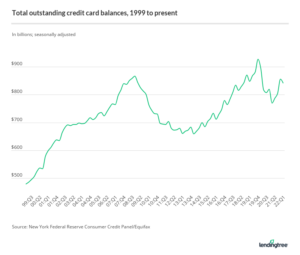

According to the Federal Reserve Bank of New York’s quarterly report on household debt and credit, a record-setting 537 million credit card accounts were opened in the first quarter of 2022. That’s 31 million more than the same period in 2021. Total credit card balances in the first quarter of 2022 were $841 billion dollars.

On average in 2021, Americans carried $5,221 in credit card balances. Alaskans have the highest average credit card balance of $8,026 and Iowans have the lowest average credit card balance of $4,774. As people increase those balances, required payments will go up threatening to squeeze already strained households who live paycheck-to-paycheck and whose wages aren’t keeping up with inflation. With the strain on household incomes, it’s likely that individuals will make minimum payments on those credit cards, taking much longer to pay off those balances.

According to The Balance, an online website that provides personal financial advice, making minimum payments only on a credit card balance of $5,000 with a minimum payment of 2% and an average APR of 20.28% (as of June 2021), it would take more than 30 years and a total of $23,399 to pay off that initial $5,000 balance. That doesn’t include any fees you might pay over the life of the credit card balance. Increasing your payments to $150 a month would allow you to pay off the same debt in a little over 16 years, for a total of $10,912.

The unanswerable question is how this increasing American debt will affect the future. As credit card balances go up, even minimum payments will take more money out of already tight household budgets. Will less be saved for retirement? Will people be forced to work longer because they can’t afford to retire? And what happens when they just can’t work anymore?

Yes, this latest chapter in the inflation saga is still being written, and debt will play a large part in the outcome.