For months we’ve heard stories about record-high inflation not seen in the United States in more than 40 years. There’s been a plethora of reports about skyrocketing grocery prices, fuel prices, food shortages, and the doubling of power and utility bills. People talk constantly about the way inflation is affecting their budgets—the devastating financial effects.

But now, information is surfacing about an equally damaging effect of sky-high inflation—the emotional effect. A new survey has discovered that a large percentage of Americans are so emotionally distraught by what inflation is doing to them that they are literally crying about their financial situation with more than 90% saying they’ve cried about money more than once.

LendingTree, a leading online financial services firm, conducted the survey which found:

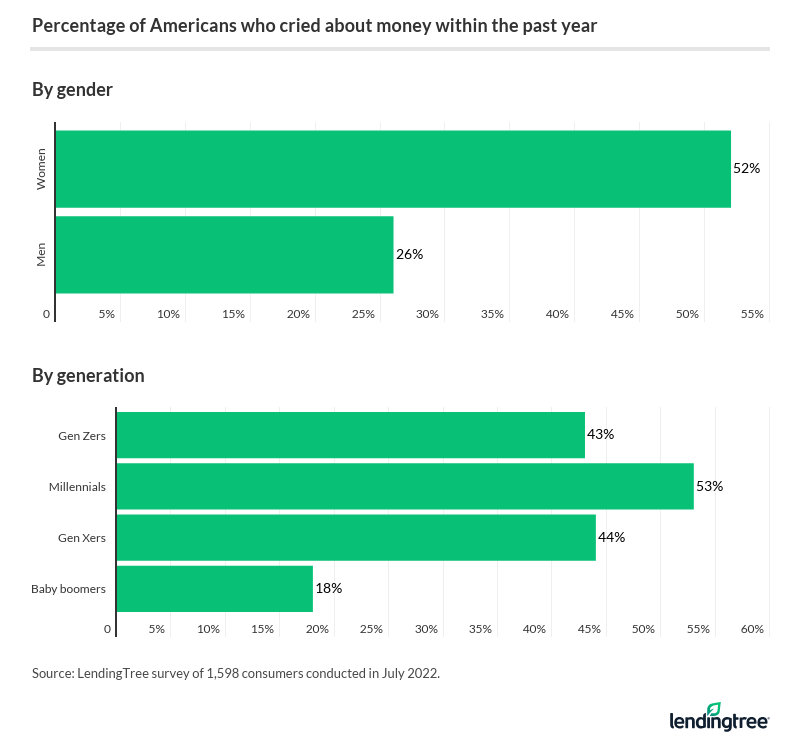

- 40% of Americans say they’ve cried about money in the past year.Consumers most likely to shed tears over their finances include those unemployed and looking for work (59%), parents with children younger than 18 (53%), millennials (53%), and women (52%).

- The top three reasons consumers cried about money over the past year are not being able to afford things their family wants or needs (46%), inflation (39%), and debt (34%).

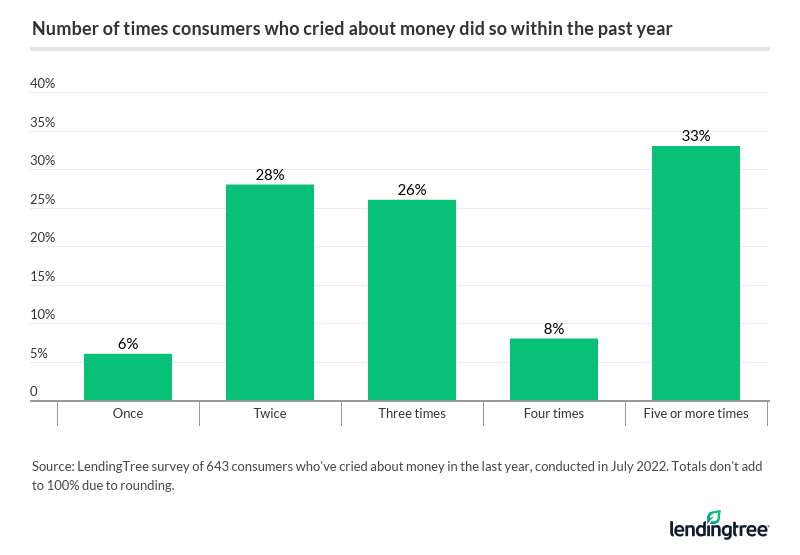

- 94% of those who cried about money did so more than once.

Those most likely to say they’ve cried in the past year were most likely to have done so multiple times. Women are nearly twice as likely as men to say they cried five or more times in the past year — 39% versus 20%. Americans with the lowest incomes ($35,000 or less) are more than twice as likely as those with the highest incomes ($100,000 or more) to say they cried five or more times in the past year — 45% versus 19%.

While parents of young children are far more likely than those with no kids to have cried at least once, there was little difference between the two groups in terms of how often those who cried did so. Among those with no kids, 32% of those who cried did so five or more times, compared with 30% among parents of young kids.

- Women and millennials are the most likely to shed tears about their financial situation.

For example, women are twice as likely as men to say they’ve cried over money in the past year — 52% versus 26%.

The gap is smaller among some of the generations. Millennials ages 26 to 41 (53%) are significantly more likely than Gen Xers ages 42 to 56 (44%) or Gen Zers ages 18 to 25 (43%) to say they cried over money in the past year. Millennials are nearly three times as likely as baby boomers ages 57 to 76 (18%) to say so.

Some of the disparities are more predictable:

- Those making $35,000 or less a year are twice as likely to say they’ve cried over money in the past year as those making $100,000 or more (50% versus 25%)

- Those with kids younger than 18 are far more likely to have done so than those with no children (53% versus 36%)

- Those unemployed and looking for work are far more likely to say they’ve cried over money in the past year than those working full time (59% versus 43%)

These consumers most commonly cry about money at home (90%), followed by in their car (22%), at work (8%), or at a friend or family member’s house (7%).

More than half of them (53%) were alone, while 40% were with someone supportive. Among those who cried in front of someone, 10% say they made up another reason for their tears.

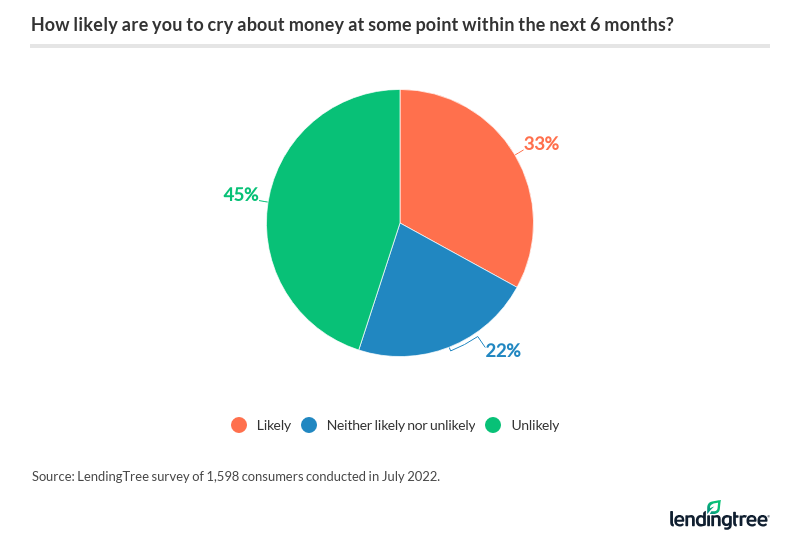

- As hard as the past year has been for many Americans, some expect the tears to keep coming.A third of consumers (33%) say they will probably cry about money in the next six months. That number goes up to 43% among parents with children younger than 18 and 41% among women and millennials.

Inflation is almost always thought of in terms of financial effect, often expressed by anger. This survey points out the emotional effect of inflation, being expressed by fear.