Celebrities are often placed on a pedestal because of their success and their extraordinary talent—people like Elvis, Aretha Franklin, Prince, Michael Jackson, Howard Hughes, Pablo Picasso, Bob Marley and Jimi Hendrix. They were gifted and they made boat-loads of money doing what they did best.

But making money has no correlation to handling money. And in the case of everyone mentioned, they all died with no estate plan. Because there was no plan, settling their estates took years, and in some cases, like Howard Hughes, decades. In the end, untold millions of dollars that could have gone to their heirs went to the IRS and to their states of residence because there was nothing in place to protect their fortunes. The top federal estate tax rate is 40%. State rates vary. For example, in Minnesota where Prince lived, the state estate tax rate is 16%.

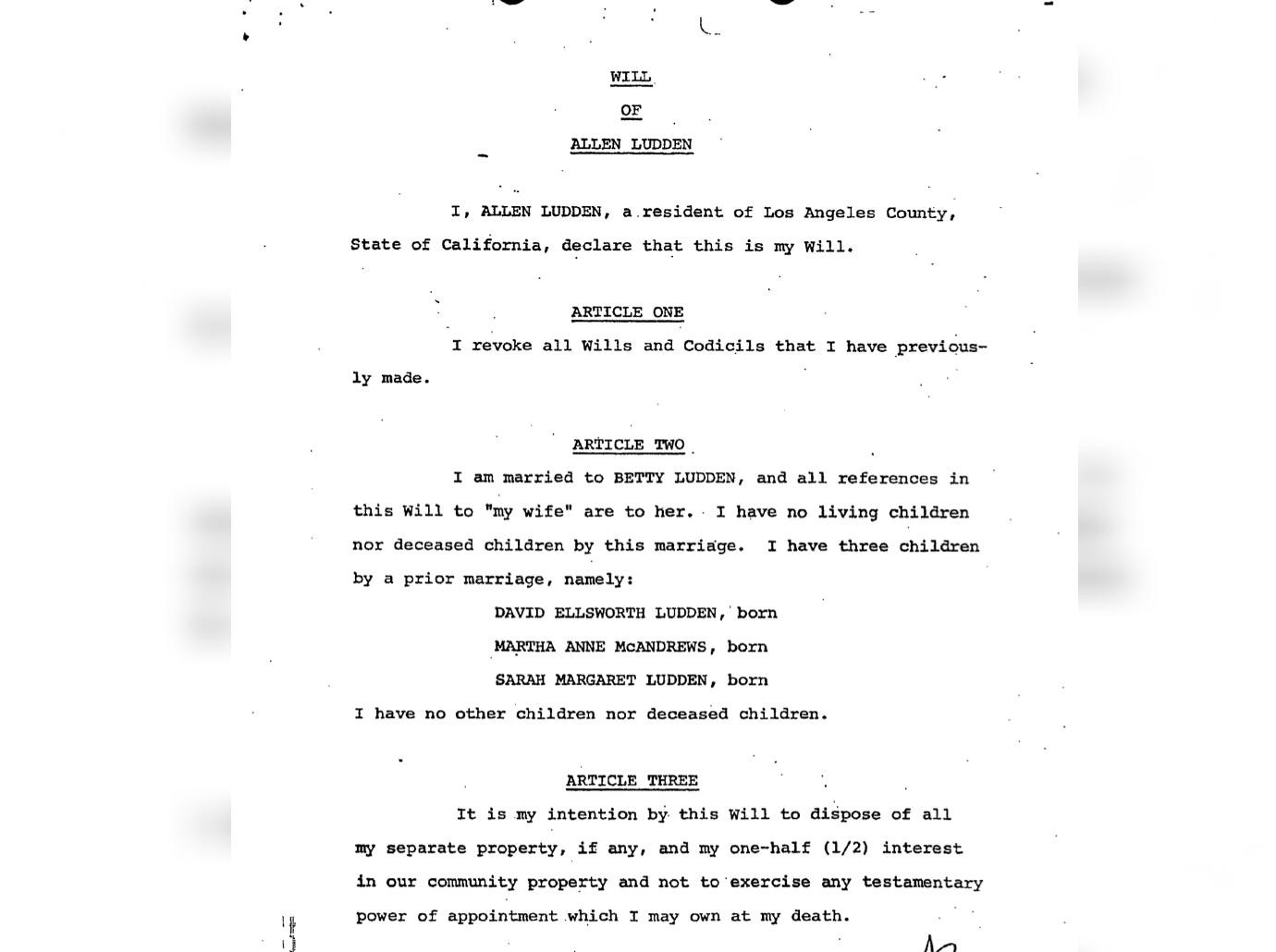

Betty White and her late husband, Allen Ludden, were not like other celebrities. They were financially savvy and understood the importance of having a plan to protect them and preserve their estate.

Source: Wikimedia Commons

Betty married Ludden, in 1963. He was an actor and singer, but is best known as the host of the game show Password, which aired from 1961 to 1980. The couple had no children of their own, but Ludden had three children from a previous marriage.

Ludden wanted to make sure Betty was taken care of in case something happened to him. According to court documents, Ludden drafted a Will in 1979, one year before he was diagnosed with stomach cancer. He died in 1981 at the age of 63.

The Will divided Ludden’s estate into two trusts. One trust was to take care of White during her lifetime. It contained a provision that White was to be paid extra from the Ludden estate if she ever experienced an emergency. It says:

“From time to time during the life of my wife if it appears to the satisfaction of the Trustee that the income distributable hereunder is insufficient to maintain my wife in accordance with the standard of living enjoyed by her at my death” the trustee is allowed to distribute additional money for any sort of accident, illness or other misfortune.”

The second Trust was to take care of Ludden’s brother, children and grandchildren. Betty was named co-trustee of both Trusts.

Betty maintained a close relationship with her three step-children and made sure they were taken care of after their father died. In 2008, as trustee, White went to court asking for the terms of the will to be modified after her co-trustee died. She made it clear to the court that she had talked to all of the Ludden children, and they came up with two people who would become trustee when White passed away. She explained that all the children agreed with her decision to modify the will and the judge immediately signed the motion.

Betty White died on December 31st, 2021, just 17 days shy of her 100th birthday. Since then, details of her estate and how it’s to be distributed have been almost non-existent. There’s been no talk about probate and no talk of a Will, which are both public and would allow anyone to know the details of what is in the estate, what happens to it, and who gets it.

The silence indicates the presence of an estate plan using a Trust. And while Trusts are private, property records are public, and at least one of White’s real estate properties was held in a Trust.

Her estate has been estimated at $75 million. San Diego, California attorney Rodney Hatley said,

“Because Betty White’s home was owned by a Trust, it will avoid probate, which is expensive, public, and time-consuming. If Betty had only had a will, or no plan at all, then the probate fees for her home would have been $126,000, or 3% of the value of that asset. Betty received good advice from her estate planning attorney and saved her estate hundreds of thousands of dollars.”

Source: David Shankbone, CC BY 2.0 <https://creative

commons.org/licenses/by/2.0>, via Wikimedia Commons

The 3% he quoted is just for the one house. If we stick with Hatley’s estimate of 3%, the probate fees, had Betty not done proper planning with a Trust to avoid probate, would have been approximately $2,250,000. In some places, probate fees can go as high as 6%.

We may never know many details about the settlement of Betty White’s estate, but there are some lessons to be learned from her story. A well-constructed estate plan:

- Avoids the probate process and associated expenses

- Provides privacy

- Protects and preserves assets

- Minimizes federal and state taxes

- Addresses family dynamics, such as divorce or blended families

Your estate may not be the size of Betty White’s, but it is just as important to you and your family. Don’t put off creating an estate plan that makes sure they’re protected and taken care of after you’re gone.