What’s that I hear? It’s very faint, but it sounds familiar. I cup my hand around my ear to hear better and, yes, I’ve heard it before. In the distance, there are shouts of “Abolish the IRS. We want a Fair Tax.”

The idea of a Fair Tax was first introduced in 1999 by former Georgia Congressman John Linder. His battle cry has been picked up again in the current Congress. On January 9, 2023 H.R. 25, the Fair Tax Act bill, was introduced in the U.S. House of Representatives. Part of the bill says:

“This bill imposes a national sales tax on the use or consumption in the United States of taxable property or services in lieu of the current income taxes, payroll taxes, and estate and gift taxes. The rate of the sales tax will be 23% in 2025, with adjustments to the rate in subsequent years. There are exemptions from the tax for used and intangible property; for property or services purchased for business, export, or investment purposes; and for state government functions.

Under the bill, family members who are lawful U.S. residents receive a monthly sales tax rebate (Family Consumption Allowance) based upon criteria related to family size and poverty guidelines.

The states have the responsibility for administering, collecting, and remitting the sales tax to the Treasury.

Tax revenues are to be allocated among (1) the general revenue, (2) the old-age and survivors insurance trust fund, (3) the disability insurance trust fund, (4) the hospital insurance trust fund, and (5) the federal supplementary medical insurance trust fund.

No funding is authorized for the operations of the Internal Revenue Service after FY2027.

Finally, the bill terminates the national sales tax if the Sixteenth Amendment to the Constitution (authorizing an income tax) is not repealed within seven years after the enactment of this bill.”

History of U.S. Taxes

The idea of a national sales tax goes all the way back to the colonies. In the 18th and 19th centuries, there was no such thing as income taxes. The U.S. funded itself through tariffs and sales taxes. But eventually, the government decided it needed more money and began passing legislation to tax individuals, too.

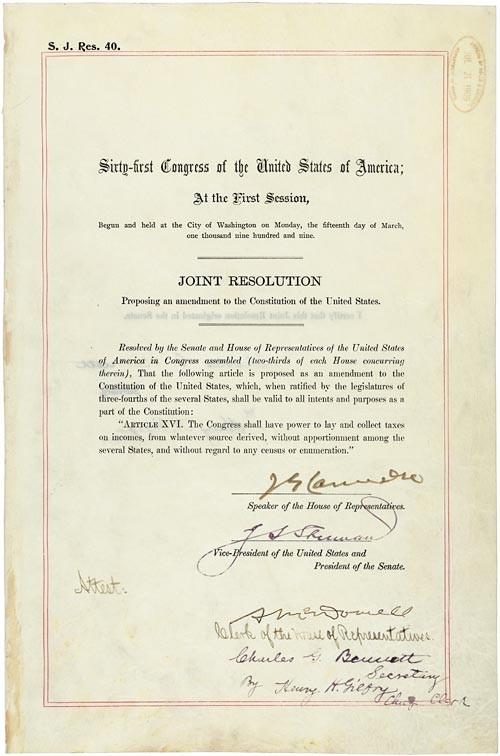

During the Civil War, Congress passed the Revenue Act of 1861 which included a tax on personal incomes to help pay war expenses but the tax was repealed ten years later. However, in 1894 Congress enacted a flat rate Federal income tax, which was ruled unconstitutional the following year by the U.S. Supreme Court because it was a direct tax not apportioned according to the population of each state. Then, on July 2, 1909, Congress passed the 16th amendment, which was not ratified until 1913, which removed this objection by allowing the federal government to tax the income of individuals without regard to the population of each state.

The Wealth Tax of 1935

During the Great Depression, President Franklin D. Roosevelt’s New Deal programs put millions of jobless Americans back to work and stabilized the economy. Social Security programs provided pensions to those who could not work. However, the government needed new taxes to pay for these programs. The Revenue Act of 1935 put a new progressive tax, the Wealth Tax, in place. Those making more than $5 million a year were taxed up to 75 percent. Unlike their Civil War grandparents, the wealthy were not happy to pay income taxes during crisis times. Loopholes in the tax code were used. The federal government aggressively prosecuted tax evaders. The Revenue Act of 1937 cracked down on tax evasion by revising tax laws and regulations.

The Victory Tax of 1942

In 1939 only about five percent of American workers paid income tax. The United States’ entrance into World War II changed that figure. The demands of war production put almost every American back to work, but the expense of the war still exceeded tax-generated revenue. President Roosevelt’s proposed Revenue Act of 1942 introduced the broadest and most progressive tax in American history, the Victory Tax. Now, about 75 percent of American workers would pay income taxes. Because so many citizens paid the tax, it was considered a mass tax. To ease workers’ burden of paying a large sum once a year, and to create a regular flow of revenue into the U.S. Treasury, the government required employers to withhold money from employees’ paychecks. Additional taxes were put in place in 1943. By war’s end in 1945, about 90 percent of American workers submitted income tax forms, and 60 percent paid taxes on their income. The federal government covered more than half its expenses with new income tax revenue.

In Favor

Proponents of the fair tax say:

- No American under the poverty level would pay taxes.

- Americans would keep 100 percent of their paychecks (minus any state income taxes).

- It would end corporate taxes and compliance costs hidden in the retail cost of goods and services.

- There would be no tax on the purchase of used goods (used car, used home, used appliances, etc.),

- Brings jobs back to the U.S. by removing the cost of corporate taxes and compliance costs from the cost of U.S. exports, putting U.S. exports on a level playing field with foreign competitors.

- Would fully fund the federal government.

- Would insure the full funding and viability of the Social Security and Medicare programs.

- Would repeal the 16th amendment to the constitution.

Not in Favor

Those who oppose the fair tax say:

- It raises incentives for private businesses to cheat. Businesses that want to undercut the competition may decide to cut out sales tax collection, especially businesses that deal with cash or checks rather than electronic payments.

- Tax rates may fluctuate as consumption changes driving up the tax rate over the long term.

- Middle-income families may see higher taxes. “Prebates” may keep taxes low for people with low incomes, but those with middle incomes may see higher tax rates, especially those paying for childcare and other large out-of-pocket expenses.

- The potential to slow overall economic growth. Since prices will be higher because of the Fair Tax, National Sales Tax, or Consumption Tax-whatever label you put on it—many individuals may choose to “insource” their consumption rather than spending on things like haircuts, eating out, childcare, or fixing cars. This could lead to a slowdown in GDP.

The likelihood of H.R. 25 passing with a split congress and a democrat president is slim. But even if the Fair Tax idea is pushed out of the limelight again, you can be sure the discussion about taxes and who should pay and what is fair will continue ad nauseum. To quote an old phrase from Ted Mack on the 1940’s Original Amateur Hour… “Round and round she goes, and where she stops nobody knows!”