The Bureau of Labor Statistics released the Consumer and Producer Price indexes this week. Consumer prices fell 0.1% in June while Producer prices rose 0.2%. The former was a positive surprise while the latter was a negative surprise.

From the BLS press release on CPI:

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent on a seasonally adjusted basis, after being unchanged in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.0 percent before seasonal adjustment.

The index for gasoline fell 3.8 percent in June, after declining 3.6 percent in May, more than offsetting an increase in shelter. The energy index fell 2.0 percent over the month, as it did the preceding month. The index for food increased 0.2 percent in June. The food away from home index rose 0.4 percent over the month, while the food at home index increased 0.1 percent.

From the BLS press release on PPI:

The Producer Price Index for final demand advanced 0.2 percent in June, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices were unchanged in May and increased 0.5 percent in April. (See table A.) On an unadjusted basis, the index for final demand rose 2.6 percent for the 12 months ended in June, the largest advance since moving up 2.7 percent for the 12 months ended March 2023.

The June rise in the index for final demand can be traced to a 0.6-percent increase in prices for final demand services. In contrast, the index for final demand goods decreased 0.5 percent.

Comment

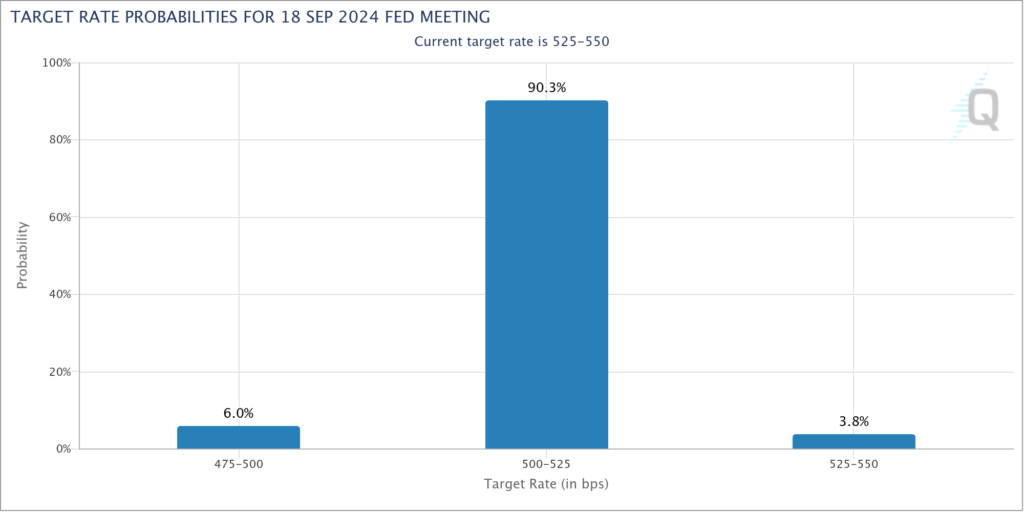

The better than expected CPI produced a big rally in bonds (interest rates fell) as expectations for a Fed rate cut ramped up. The probability of a cut in September rose to 88% while a cut in November now has odds greater than 50%. The worse than expected PPI didn’t produce much response at all, likely because the ex-food, energy and trade portion of the index showed no change.

A look at the internals of the two reports offers several reasons investors might want to temper their enthusiasm. The drop in consumer prices was driven by a drop in energy prices of 2% and most of that was due to a 2.8% drop in gasoline prices. While that is welcome, gasoline prices are volatile and inventories have dropped in 15 of the last 23 weeks. In addition, shelter prices are still rising, although at a slower pace, up 5.1% over the last year.

On the produce price side, the rise in services prices and drop in goods prices is consistent with the trends in consumption but goods consumption seems likely to rise if interest rates continue to drop. A lot of the moderation in goods consumption is tied to the housing market and lower mortgage rates should induce greater activity. In addition, the drop in goods prices was led by a 2.6% drop in energy prices.

Overall, we don’t think these reports really change any trends. The inflation rate is falling but Consumer prices are still up 3% year over year with core inflation up even more at 3.3%. That is still much too high and we question whether the Fed can reduce it much more without causing a recession. Will the Fed cut in September? Based on Chairman Powell’s testimony to Congress last week, which we took to be dovish, we think the answer is yes. But we still have 3 inflation reports before that meeting and he has said repeatedly that they need to see more progress. The inflation data this week moves things in that direction some but probably not enough.