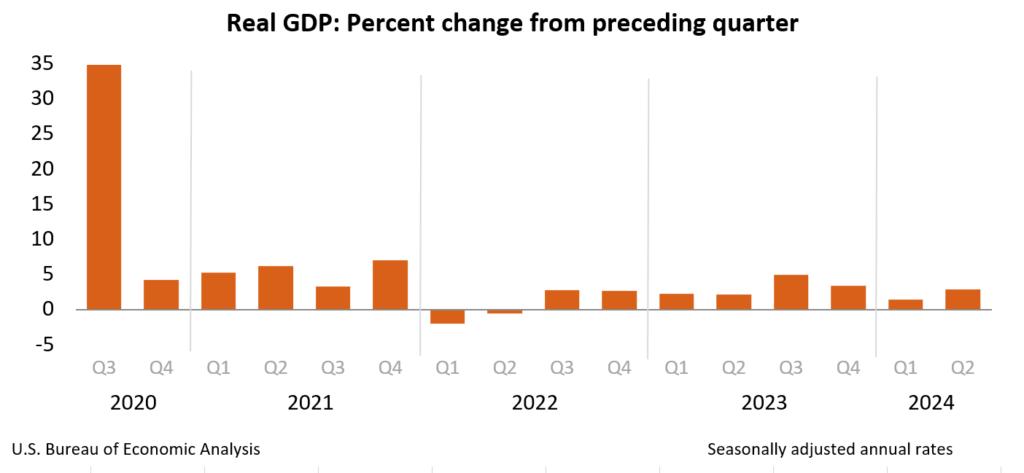

Real gross domestic product (GDP) increased at an annual rate of 2.8 percent in the second quarter of 2024, according to the “advance” estimate released by the U.S. Bureau of Economic Analysis. In the first quarter, real GDP increased 1.4 percent.

The increase in real GDP primarily reflected increases in consumer spending, private inventory investment, and nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

The increase in consumer spending reflected increases in both services and goods. Within services, the leading contributors were health care, housing and utilities, and recreation services. Within goods, the leading contributors were motor vehicles and parts, recreational goods and vehicles, furnishings and durable household equipment, and gasoline and other energy goods. The increase in private inventory investment primarily reflected increases in wholesale trade and retail trade industries that were partly offset by a decrease in mining, utilities, and construction industries. Within nonresidential fixed investment, increases in equipment and intellectual property products were partly offset by a decrease in structures. The increase in imports was led by capital goods, excluding automotive.

Compared to the first quarter, the acceleration in real GDP in the second quarter primarily reflected an upturn in private inventory investment and an acceleration in consumer spending. These movements were partly offset by a downturn in residential fixed investment.

Current‑dollar GDP increased 5.2 percent at an annual rate, or $360.0 billion, in the second quarter to a level of $28.63 trillion. In the first quarter, GDP increased 4.5 percent, or $312.2 billion.

The price index for gross domestic purchases increased 2.3 percent in the second quarter, compared with an increase of 3.1 percent in the first quarter. The personal consumption expenditures (PCE) price index increased 2.6 percent, compared with an increase of 3.4 percent. Excluding food and energy prices, the PCE price index increased 2.9 percent, compared with an increase of 3.7 percent.

Commentary

We track the Atlanta Fed’s GDPNow, the Chicago Fed National Activity Index and the NY Fed’s Weekly Economic Index, all of which told us to anticipate this result. The Atlanta GDPNow estimate just prior to the release was 2.6%, the 3 month average of the CFNAI was -0.01 in June (indicating growth at trend) and the WEI was at 2.22 at the end of June (the average since 2000 is 1.65. All of those readings are consistent with growth at or just above trend. The average year over year change in real GDP since 2000 is 2.11% and we take that as trend growth.

From quarter to quarter the variable that is least accurate is inventory because the most recent figures are still two months behind. Trade presents the same problem. In this quarter, inventory was estimated to add 0.82% to the total GDP so ex-inventory growth was right on trend. Trade subtracted -0.72% from the total (imports rose more than exports). The trade figures, if accurate, actually reflect a pretty strong economy. Imports shrink during recession and expand when the economy is growing. We have been anticipating this rise in imports because the inventory overhang created by COVID has been depleted. Restocking will require a rise in imports and domestic production, both of which are starting to happen now.

An interesting detail from this report is the change in Gross Private Domestic Investment which rose 8.4% from last quarter. Residential investment fell 1.4%, which isn’t surprising given the inventory issues at homebuilders (see here). Non-residential investment accelerated, up 5.2% from last quarter which was up 4.4% from the previous quarter which was up 3.7% from the previous quarter. I’m starting to sense a trend. But the interesting part is in the details. Investment in structures, which has been surging since late 2022, fell by 3.3% while investment in equipment, which had been lagging (negative 4 of the last 6 quarters) surged 11.6%.

I don’t know exactly what is causing that but my best guess is that it has to do with AI investment. We know data center construction has been off the charts and my guess is that the spending just shifted from the building of facilities to making them operational. Just a guess but probably a pretty good one. It could be related to CHIPS Act spending too but the timeline of construction of a semiconductor plant is measured in years so I have my doubts.

NGDP

Nominal GDP rose 5.2% in the quarter, with 2.8% real growth and 2.4% inflation. I think the Fed would love to see those numbers at 2.5% real growth and 2% inflation but they really don’t have any control over that. The question is whether the current split is acceptable and I think the answer is probably yes. If so, that also means that the current Fed Funds rate of 5.25% to 5.5% is still a little too high. A FF rate equal to NGDP growth would be about right so maybe a 25 basis point cut is in order. If the economy continues to grow at this pace, the current expectation of three rate cuts by year end is likely to be disappointed.